A Profitable Outlier in Cannabis: Why Decibel Might Be Quietly Turning the Corner”

From commodity grower to premium brand operator - Decibel is quietly compounding in plain sight.

1. The Thesis in 100 Words

Decibel Cannabis is a $75M microcap that has quietly become one of the most efficient premium cannabis producers in Canada. With strong consumer brands (Qwest, General Admission), disciplined capital allocation, and clear leverage reduction underway, DB is evolving from a turnaround to a free cash flow story. Despite record revenue and margins that rival large peers, the market still prices it like a distressed operator. With debt paydown accelerating and consistent EBITDA growth, a rerating toward 1.5–2x sales or 8–9x EBITDA could double the stock in 12–18 months.

2. Snapshot: The Numbers

Market Cap: ~$75M

EV/EBITDA: ~5x (peers 8–10x)

Revenue (TTM): ~$125M, up 30% YoY

EBITDA (TTM): ~$15M, margins above 12%

Net Debt: ~$45M, declining quarterly

Insider Ownership: ~20%

Cash Flow: Positive, with debt repayments visible in filings

3. The Story

Decibel was once a struggling grower in Alberta but has transformed into a vertically integrated premium brand operator. Its flagship brand Qwest commands some of the highest price-per-gram metrics in the country, while its value line General Admission targets the mass market effectively. This barbell brand approach has let it win share in both high-end and mainstream categories.

Where peers chased scale, Decibel built brand equity and operational discipline. The company now ranks among the top five Canadian LPs by sales in several provinces, yet trades at a fraction of their multiples. Management’s focus on consistent execution and cost control is reshaping its reputation from speculative to sustainable.

4. The Setup

Decibel is entering a clean-up phase: debt is being steadily reduced, and operations are consistently cash generative. The next phase is optionality - U.S. exposure or uplisting potential as regulatory clarity improves. Market sentiment has not yet caught up with the company’s improved fundamentals.

Why now:

Rapid deleveraging could trigger a rerating

Continued sales growth despite sector stagnation

Brand strength in both premium and mainstream

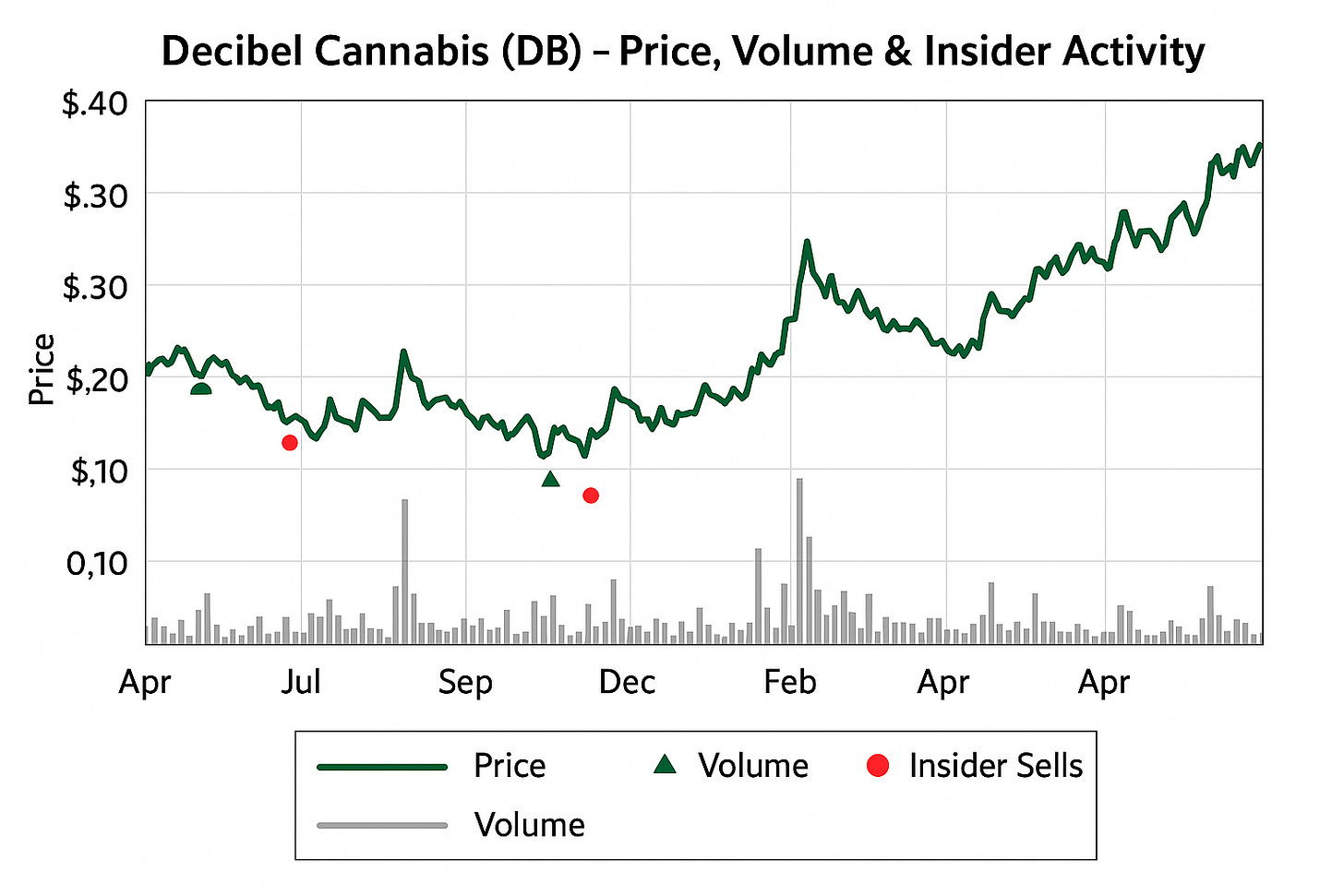

Improving liquidity and volume on TSXV

Risks remain: low float, high debt (though falling), and limited institutional coverage.

5. Valuation Framework

FY2025 EBITDA (base): $16M

Peer multiple: 9x EV/EBITDA

Target EV: $144M

Target Market Cap: ~$110M

Current Market Cap: ~$75M

Implied Upside: ~45% (Base Case)

Bull Case: 12x multiple = 100% upside

Bear Case: slower debt reduction or sector compression = -20%

6. The Risks

Structural Risks

Sector overcapacity still limits pricing power

Limited liquidity may cause volatility

Debt load, while improving, remains material

Execution Risks

Brand dilution or product recall

Regulatory delays for potential U.S. opportunities

Possible dilution if equity used to refinance

Still, the company has proven operationally resilient and cash generative even in weak market conditions.

7. The Insider View

Insider ownership around 20% keeps management aligned. Recent SEDI filings show modest insider buying during 2024, signalling internal confidence. CEO Paul Wilson has focused on steady, repeatable growth and deleveraging rather than promotional tactics - a refreshing change in the cannabis space.

8. The Catalyst Roadmap

Q4 2025 - Continued debt paydown update

Q1 2026 - Potential TSX uplisting discussion

FY2026 - Free cash flow inflection

H1 2026 - Sector sentiment recovery or consolidation event

Each of these could tighten valuation gaps between DB and peers.

9. The Takeaway

Decibel is no longer a speculative cannabis grower but a disciplined brand operator with consistent profitability. The market still hasn’t recognized the transformation, giving patient investors an asymmetric setup. With strong brands, cash flow, and leverage coming down, DB looks positioned for a quiet but powerful rerating.

Disclosure: This analysis is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. All opinions are based on publicly available information believed to be accurate at the time of writing but are not guaranteed. Investors should perform their own due diligence and consult a licensed financial advisor before making any investment decisions.

I like DB as well. Nice mix of solid brands, international expansion, insider ownership and deleveraging. As well, pretty reasonable valuation.