A regional roll-up with automation tailwinds, priced like the cycle never turns

Housing softness crushed margins, but footprint, automation, and two new tuck-ins set up an operating rebound.

1. The Thesis in 100 Words

Atlas Engineered Products designs and manufactures roof trusses, floor trusses, wall panels, and related engineered wood products for residential and light commercial builds across Canada. After a tough first half of 2025 with competitive pricing pressure, AEP still grew footprint through acquisitions and is commissioning automation that should lift throughput and margins. With a sub-CA$55M market cap and an EV under CA$70M, investors get a national platform with insider alignment and clear operating levers. If volumes recover and pricing stabilizes, a return toward 2024 margin levels would re-rate the stock from today’s compressed multiples.

2. Snapshot: The Numbers

Market Cap: about CA$48M to CA$54M as of early November 2025

EV: about CA$69M

Insider Ownership: about 14 percent

Net Liquidity: June 30, 2025 cash of CA$5.3M, working capital CA$16.0M

Last Quarter Trend: first half 2025 revenue up 2 percent year over year, but gross margin compressed to 16 percent and adjusted EBITDA fell materially

3. The Story

What they sell and how they make money: engineered structural wood components and panels sold to builders. Revenue is tied to housing starts, repairs, and light commercial.

Footprint: a national family of operating companies, grown via acquisitions since 2017. Nine companies as of mid-2025.

Why it’s overlooked: thin float and microcap size, cyclical exposure, and a rough H1 2025 that masked underlying volume gains.

Management and alignment: management highlights insider ownership around the mid-teens in recent decks.

4. The Setup

Operating inflection potential: automation and an Ontario facility build are aimed at lifting throughput and labour efficiency, which could rebuild margin once pricing stabilizes.

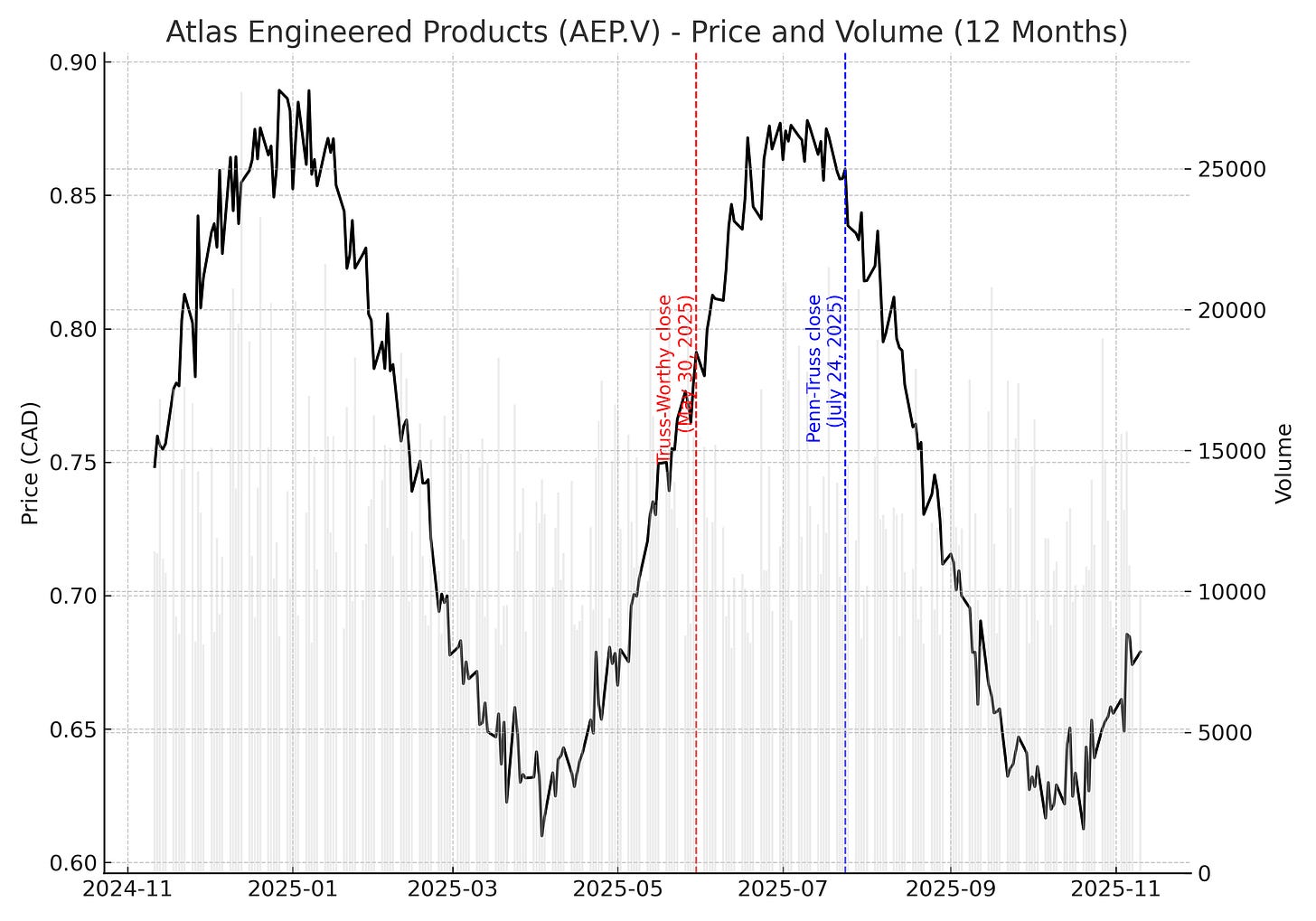

Roll-up momentum: closed Truss-Worthy on May 30, 2025, and Penn-Truss on July 24, 2025, expanding in Ontario and adding Saskatchewan reach. Integration synergies are expected.

The mismatch: despite 2024 revenue of CA$55.8M and healthy 2024 adjusted EBITDA, first-half 2025 margin compression drove sentiment and multiples down. If 2024-like margin cadence returns, current EV looks undemanding.

5. Valuation Framework

Working view, not precision math:

Reference point: 2024 adjusted EBITDA was CA$8.5M. First half 2025 adjusted EBITDA was roughly CA$1.4M on weaker pricing. If pricing and throughput normalize and AEP can exit 2026 near CA$6M to CA$9M of adjusted EBITDA, a 8x to 10x EV/EBITDA range implies EV of CA$48M to CA$90M. Versus an EV near CA$69M today, that brackets downside if margins stay weak and upside if margins rebound and acquisitions contribute.

Translation to equity depends on net debt at that time and any share issuance for deals or earn-outs. This is a margin-swing story more than a revenue-beta story.

6. The Risks

Structural

Illiquidity and microcap volatility, which can widen bid-ask spreads and make entries or exits slow.

Cyclical end-market exposure to housing starts and renovation cycles.

Execution

Integration of Truss-Worthy and Penn-Truss, plus delivery of automation benefits, could take longer or cost more.

Pricing pressure may persist if competitive intensity stays high, keeping gross margin near H1 2025 levels.

Financial

EV suggests modest net debt after cash, and 2025 capex and acquisitions used cash. If margins lag, leverage optics rise. Monitor covenants and cash generation.

7. The Insider View

Decks indicate mid-teens insider ownership and multiple covering brokers following the name. Track SEDI and open-market buys as a tell on timing. Atlas

8. The Catalyst Roadmap

Q4 2025 to H1 2026: automation ramp milestones and Ontario facility progress, evidence of throughput gains and labour efficiency.

2026: acquisition integration updates and cross-selling across regions, including Saskatchewan reach after Penn-Truss.

Any stabilisation in Canadian housing activity or improved pricing environment that lifts gross margin from 16 percent toward prior levels.

9. The Takeaway

AEP is a classic microcap platform that hit a cyclical air pocket. The footprint got bigger, automation is coming online, and volumes are quietly improving, but pricing pressure kneecapped margins and sentiment. If management executes on efficiency, integrates the two 2025 deals, and the market gives them even a partial margin reset, today’s EV looks reasonable with upside. Conviction depends on your view of housing activity and competitive pricing over the next 4 to 6 quarters.

10. Disclosure

This analysis is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security. The author may hold a position in Atlas Engineered Products (AEP.V). Always conduct your own due diligence and consult a registered financial advisor before making investment decisions.