The Rebuild in Motion: Why IC Group’s Comeback Story Could Surprise the Market

A marketing tech microcap with fresh capital, insider alignment, and a path to profitability.

1. The Thesis in 100 Words

IC Group Holdings (ICGH) is a C$15M marketing technology firm powering loyalty, rebate, and engagement platforms for Fortune 500 brands. After years of restructuring, the company is finally showing growth momentum, with revenue up nearly 47% YoY and a major focus on recurring SaaS-style contracts. Management has doubled down on RCS (Rich Communication Services) technology, positioning ICGH as a next-gen bridge between brands and customers. With a clean pivot, new financing, and aligned insiders, the setup resembles an early-stage digital rebounder—misunderstood, capital-constrained, and sitting on a potential inflection in revenue leverage.

2. Snapshot: The Numbers

Market Cap: ~C$15 million (deep microcap range)

EV/Revenue: ~1.2x (below martech peers at 3–5x)

Insider Ownership: ~25 percent (aligned, including founders and long-time executives)

Net Debt/Equity: ~2.3x (elevated leverage risk)

Last Quarter Revenue Growth: +46.8 percent YoY (inflection visible)

3. The Story

IC Group began as a promotional marketing business before pivoting to digital engagement solutions for major consumer brands. It builds and operates loyalty, rebate, and incentive platforms, increasingly underpinned by its proprietary communications stack. After a turbulent restructuring phase and pandemic-era downturn, new leadership refocused on scalable, tech-based revenue rather than custom agency projects.

Today, ICGH’s growth engine is a combination of platform-as-a-service contracts, data-driven promotions, and RCS integrations—allowing brands to reach mobile users without third-party cookies. Despite its scale, the company’s client list includes recognizable names, but it remains off the radar due to thin volume, TSXV listing, and limited coverage.

CEO Rob Craig, an experienced marketing executive, owns a significant equity stake. The board mix remains founder-heavy but aligned.

4. The Setup

The “why now” is clear:

The company has cleaned up its cost structure and returned to revenue growth.

A C$4M private placement (units at $0.50) funds RCS expansion and new client rollouts.

The market is mispricing ICGH versus martech peers trading at 3–5x revenue.

Insiders have participated in recent rounds, showing confidence.

Volume is slowly rising as investors notice the turnaround.

Key risks remain: limited liquidity, ongoing losses, and potential future dilution. But the setup implies a narrow window where execution could re-rate the stock from microcap neglect to small-cap visibility.

5. Valuation Framework

FY2025 Revenue: ~C$22M

Assumed EBITDA Margin (normalized): 10% → C$2.2M

Peer EV/EBITDA Multiple: 8x

Target EV: C$17.6M

Less Net Debt: ~C$3.5M

Target Market Cap: ~C$14M

At a current market cap of ~C$15M, the market is already pricing in breakeven-level performance.

If execution improves and EBITDA expands to 15% with sustained growth, upside toward C$25–30M market cap (+70–100%) is possible.

Bear case: execution stalls, capital dries up, and dilution erodes value (-40–50%).

6. The Risks

Structural Risks:

Very low liquidity (average daily volume under 25K shares)

High leverage post-financing

Small customer base with concentration risk

Potential for continued dilution

Execution Risks:

Delayed rollout of RCS platform or poor adoption

Thin margins until scale achieved

Competition from larger martech platforms

This is not a risk-free idea, but the current valuation implies near-failure expectations. Any positive earnings surprise could re-rate the stock meaningfully.

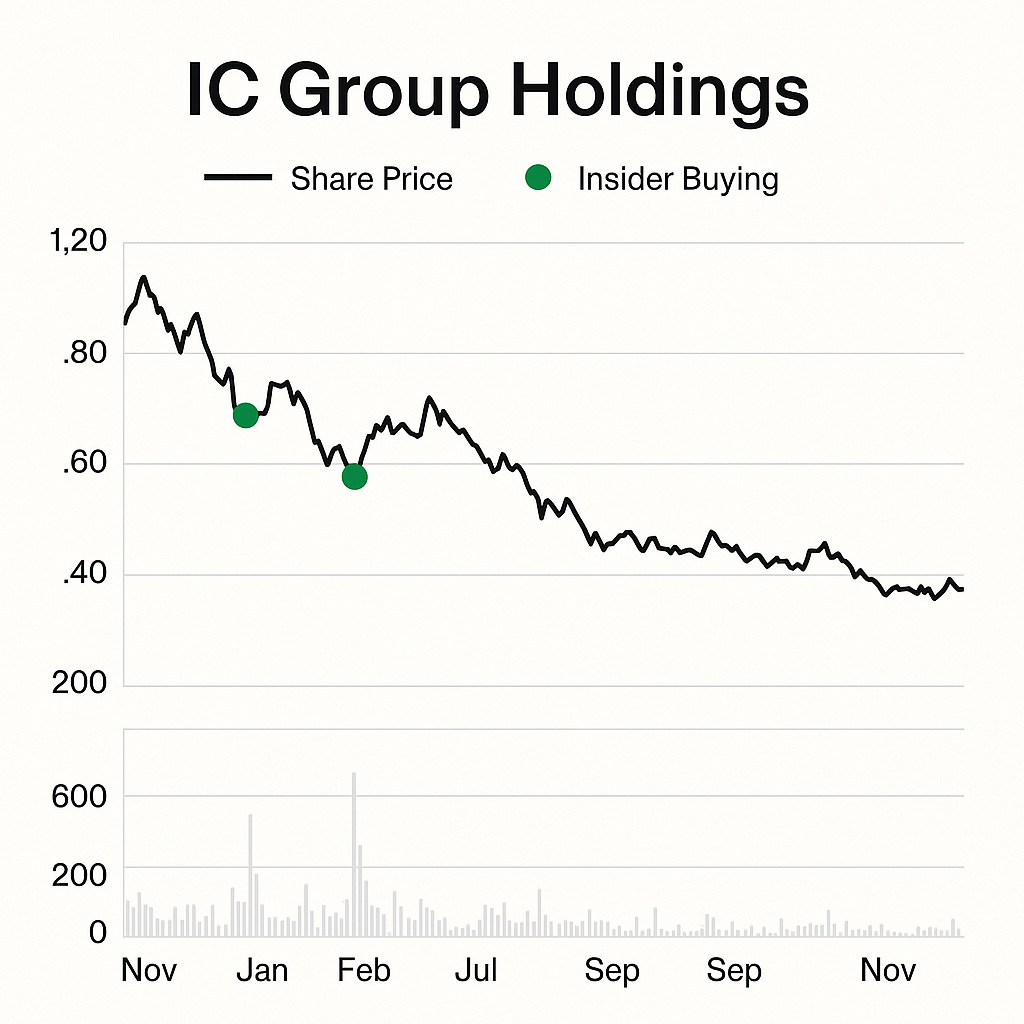

7. The Insider View

Founders and management collectively hold around 25 percent.

Insiders have participated in financings at or above current market price.

Recent SEDI filings show no insider selling.

Management compensation remains modest relative to peers—suggesting discipline and focus on turnaround rather than extraction.

8. The Catalyst Roadmap

Q4 2025 – Completion of $4M financing and deployment into RCS tech stack

Q1 2026 – Launch of new enterprise client integrations

Q2 2026 – Potential contract announcement with tier-one brand partner

FY2026 – Movement toward breakeven profitability

Each of these milestones could trigger volume and visibility shifts as the company transitions from restructuring story to growth story.

9. The Takeaway

IC Group Holdings is a tiny, overlooked martech player that has quietly rebuilt itself into a scalable digital platform. The combination of insider alignment, fresh capital, and visible growth creates an asymmetric setup—high risk, but potentially rewarding for patient investors. Execution remains the deciding factor.

Disclosure: This analysis is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. All opinions are based on publicly available information believed to be accurate at the time of writing but are not guaranteed. Investors should perform their own due diligence and consult a licensed financial advisor before making any investment decisions.