Unlocking the Canadian Micro-Cap Universe

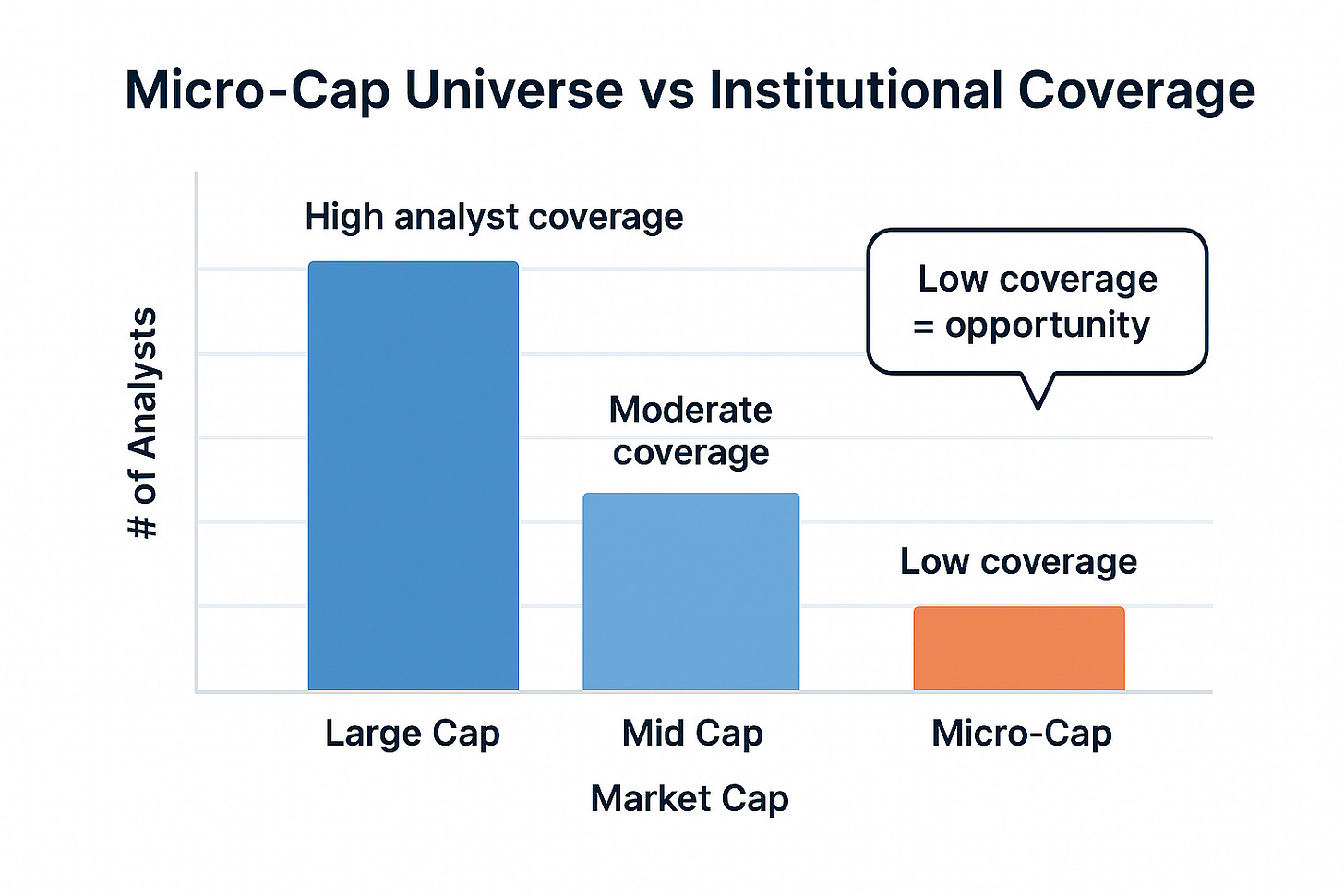

The Canadian micro-cap market is one of the most inefficient and under-covered spaces in public markets. While large institutions often overlook these companies, nimble investors and diligent research.

The Micro-Cap Discovery Cycle

Micro-cap investing is less about following trends and more about discovering early catalysts that the broader market hasn’t recognized yet. Most companies pass through a simple yet powerful discovery cycle:

1. Low Awareness – Small, under-covered companies flying under the radar.

2. Emerging Catalyst – Positive changes in fundamentals, product launches, or contracts.

3. Growing Recognition – Analyst coverage and investor attention start to increase.

4. Valuation Re-Rating – Market catches up, and the company’s value begins to reflect its potential.

Thanks for reading! Subscribe for free to receive new posts and support my work.

Understanding this cycle is key to seeing where opportunities may emerge before they’re widely recognized.

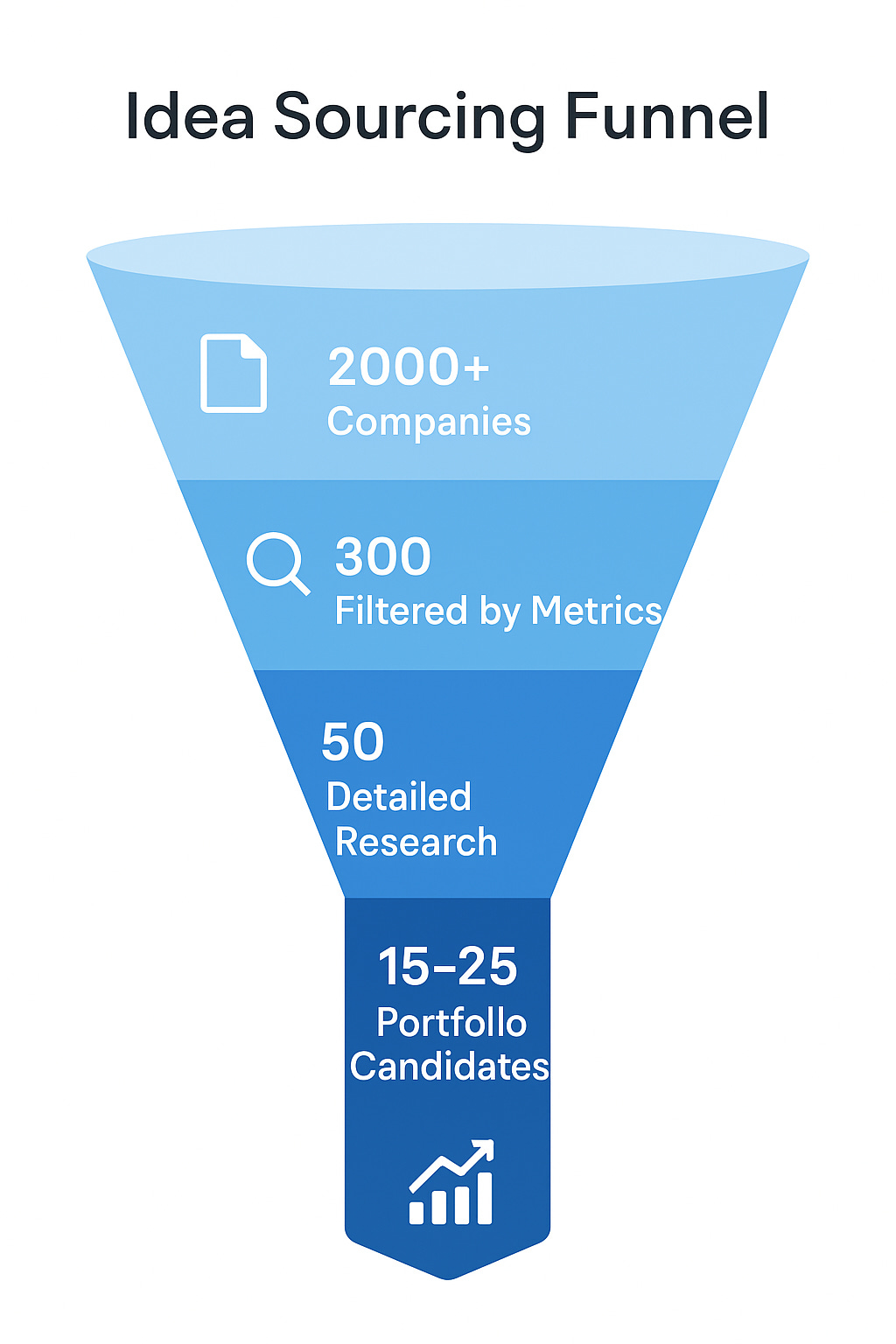

Sourcing and Filtering Ideas

We start by monitoring hundreds of Canadian micro-cap companies. This includes reviewing public filings, insider activity, news, and emerging industry trends. Our goal is to identify companies that are:

Small in market cap but showing growth potential

Experiencing operational or market catalysts

Often misunderstood or underappreciated by the market

We then filter these ideas using a combination of quantitative metrics (growth, profitability, balance sheet strength) and qualitative insights (management quality, competitive advantage, strategic initiatives).

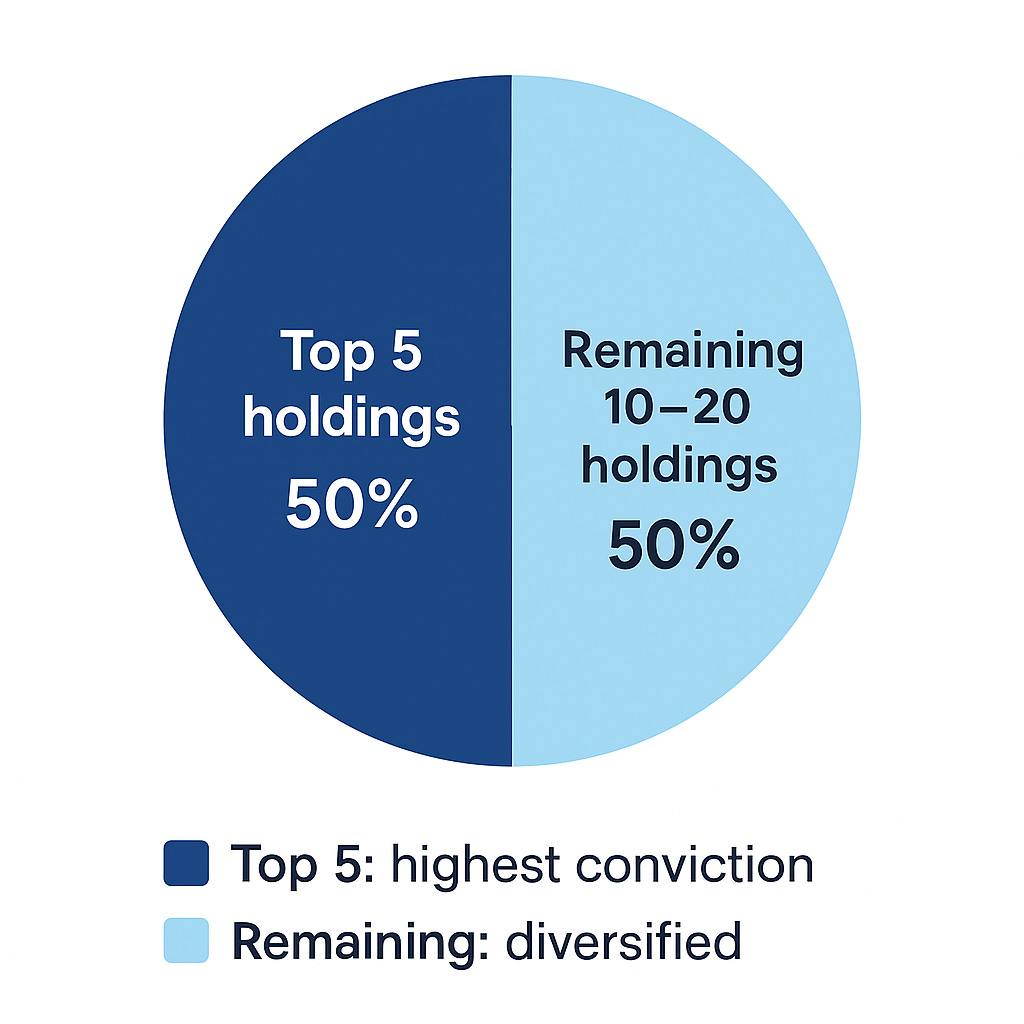

Portfolio Construction Principles

Even in a market full of exciting opportunities, discipline matters. The micro-cap space is inherently volatile, so thoughtful portfolio construction is essential. Key principles include:

Focused portfolios with a small number of high-conviction positions

Diversification to manage risk while capturing potential upside

Careful monitoring of catalysts, management performance, and valuation

The result is a portfolio that balances opportunity and risk, while staying nimble enough to act on emerging ideas quickly.

Why Micro-Caps Matter

Micro-cap companies are often overlooked by large investors, creating a fertile ground for active research and early recognition. By understanding how to identify early-stage catalysts, readers can gain perspective on opportunities that might otherwise go unnoticed.

Our goal at MicroCaps.ca is to educate and illuminate, helping you navigate this space with insights, stories, and analysis. Whether it’s highlighting a company’s operational turnaround or explaining market dynamics, we aim to make the world of Canadian micro-caps accessible and understandable.

How We Share Insights

We’ll be sharing:

Regular themes and industry trends

Company case studies illustrating early catalysts and discovery cycles

Portfolio construction insights without disclosing personal positions

Risk and reward perspectives unique to the micro-cap space

Visual placeholder: Risk/Reward Skew Illustration

Our content is informational only and not investment advice. Micro-cap investing carries inherent risks, including volatility and liquidity challenges. We encourage readers to do their own research and understand the dynamics of small-cap markets.

Thanks for reading! Subscribe for free to receive new posts and support my work.